lincoln ne sales tax calculator

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Name A - Z Sponsored Links.

The 10 Least Tax Friendly States For Middle Class Families Kiplinger

Nebraska sales tax details.

. Lincoln County NE Sales Tax Rate Lincoln County NE Sales Tax Rate The current total local sales tax rate in Lincoln County NE is 5500. Lincoln NE 68509-4877 Phone. Nebraska Department of Revenue For income tax please visit our Nebraska Income Tax Rates and Calculator page.

Department of Revenue Current Local Sales and Use Tax Rates. The Nebraska state sales and use tax rate is 55 055. The lincoln sales tax is collected by the merchant on all qualifying sales made within lincoln.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Sales Tax Table For Lincoln County Nebraska Below is a table of. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax Calculator in Lincoln NE. The lincoln sales tax is collected by the merchant on all qualifying sales made within lincoln. This is the total of state county and city sales tax.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling. The calculator will show you the total sales tax.

2021 Prime Time Tracer 22RBS Lincoln NE 24829 for sale in Lincoln from. The Lincoln County sales tax rate is. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Lincoln NE.

The December 2020 total local sales tax rate was also. Nebraska Sales Tax Rate Finder. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective.

We highly recommend that you use our Nebraska income tax calculator. As of 2019 the Nebraska state sales tax rate is 55. The December 2020 total local sales tax rate was.

The Nebraska state sales tax rate is currently. A Base Tax set in Nebraska motor vehicle statutes is assigned to the. 2021 Prime Time Tracer 22RBS Lincoln NE 24829 for sale in Lincoln from.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Nebraska Department of Revenue PO Box 98911 Lincoln. Lincoln Sales Tax Rates for 2022.

The Nebraska NE state sales tax rate is currently 55. Taxes-Consultants Representatives Financial. Get rates tables What is the sales tax rate in Lincoln Nebraska.

Sales Tax State Local Sales Tax on Food. Sales tax in Lincoln Nebraska is currently 725. Nebraska Sales Tax Calculator You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska Sales. Lincoln NE Sales Tax Rate Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Real property tax on median home. Nebraska Sales and Use Tax The Nebraska state sales and use tax rate is 55 055.

General Fund Receipts Nebraska Department Of Revenue

Nj Car Sales Tax Everything You Need To Know

State And Local Sales Tax Rates 2019 Tax Foundation

Sales Use Tax South Dakota Department Of Revenue

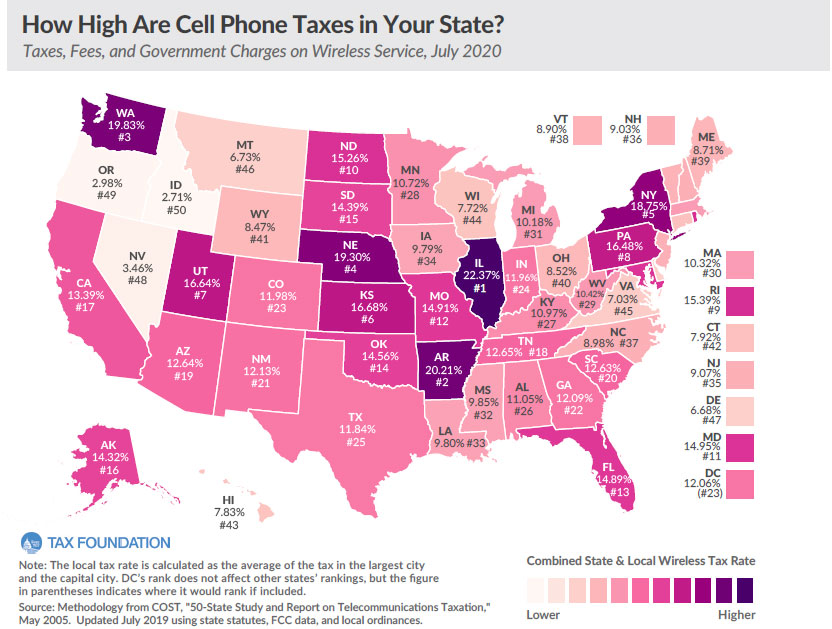

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

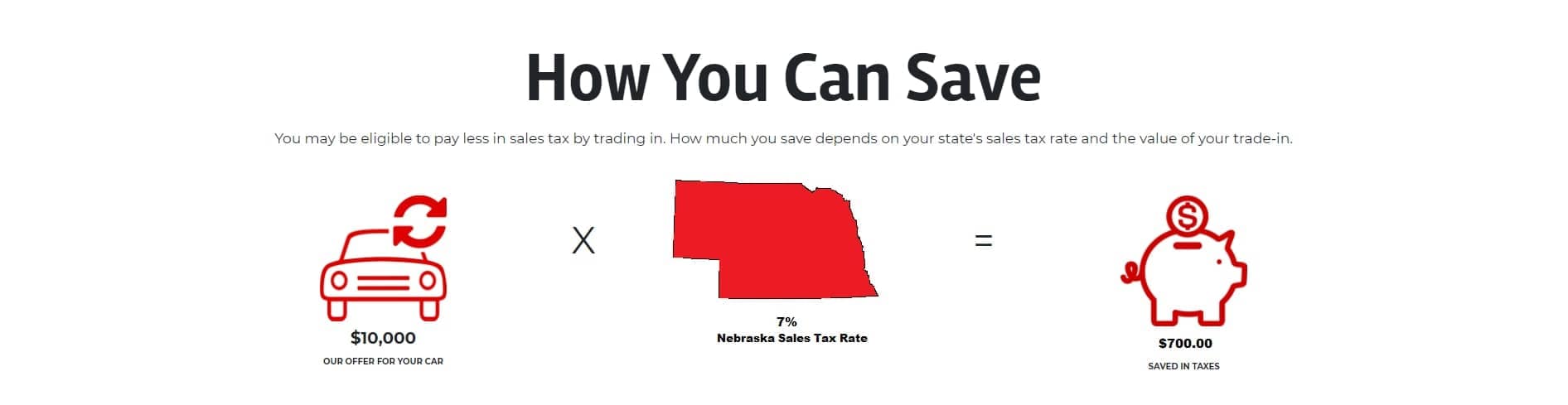

We Buy Cars Schrier Automotive

New Mexico Sales Tax Calculator

Nebraska Property Tax Calculator Smartasset

Nebraska Group Recommends Eliminating Some Sales Tax Breaks

Here S What Happens To Your Sales Tax Gobankingrates

Nebraska Sales Tax Calculator Reverse Sales Dremployee

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Prepare And File A Nebraska Income Tax Amendment Form 1040xn

Taxes And Spending In Nebraska

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Faqs Sarpy County Ne Civicengage